Paul B Insurance Part D - Questions

Table of ContentsThe Of Paul B Insurance Part D10 Easy Facts About Paul B Insurance Part D ShownNot known Facts About Paul B Insurance Part DThe Definitive Guide for Paul B Insurance Part DHow Paul B Insurance Part D can Save You Time, Stress, and Money.

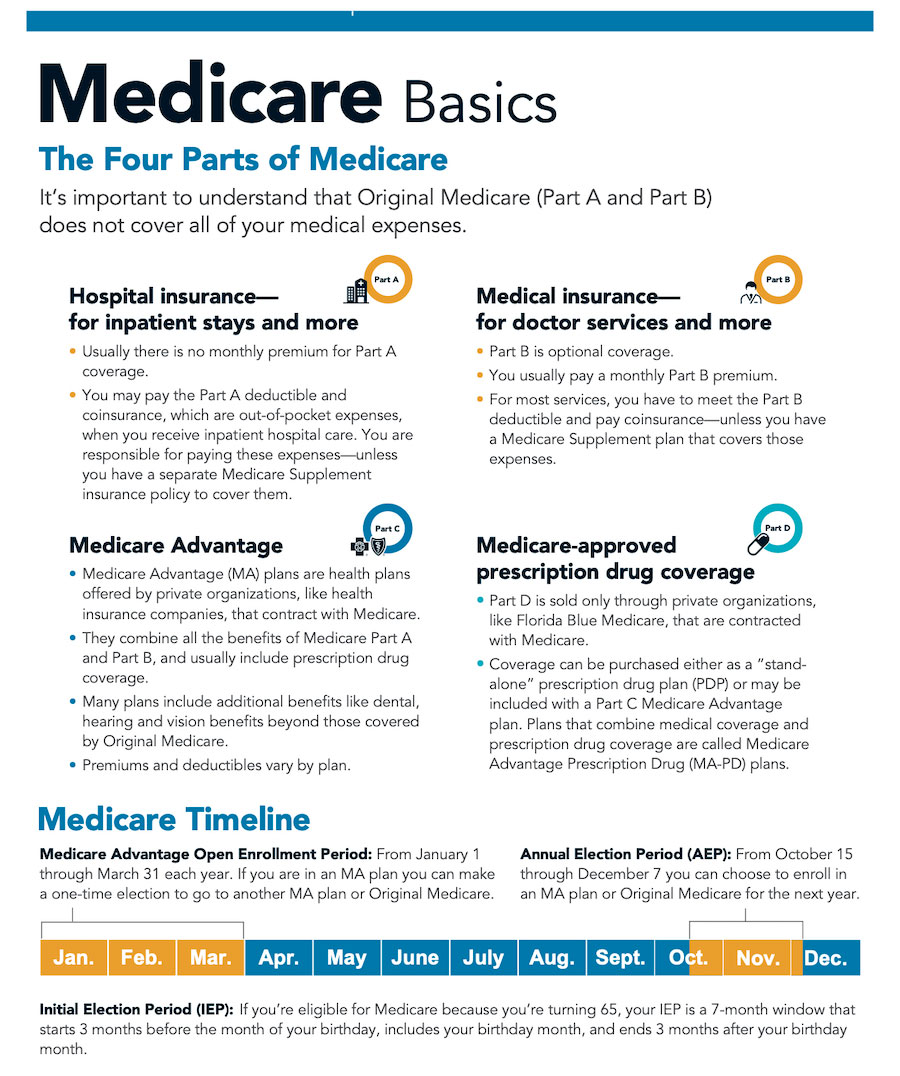

In Initial Medicare: You go directly to the doctor or medical facility when you require care. It is necessary to understand your Medicare protection options and to pick your protection thoroughly. How you pick to get your benefits and who you get them from can impact your out-of-pocket expenses and where you can get your care. For instance, in Original Medicare, you are covered to go to almost all physicians and medical facilities in the nation. Medicare Advantage Plans can also offer extra benefits that Original Medicare does not cover, such as regular vision or dental care. What is Medicare Benefit? What are the advantages and limitations of Medicare Advantage plans? Exist any protections if I enroll in a plan and do not like it? Are any Medicare Managed Care Plans readily available where I live? Medicare Benefit broadens healthcare alternatives for Medicare recipients. These alternatives were produced with the Well balanced Spending Plan Act of 1997 to reduce the growth in Medicare spending, make the Medicare trust fund last longer, and provide beneficiaries more options. It is important to keep in mind that each of these options will have advantages and restrictions, and no alternative will be right for everyone. Also, not all options will be offered in all areas. Please Keep in mind: If you do not actively pick and enlist in a brand-new plan, you will stay in Original Medicare or the original Medicare managed care plan you currently have. You should not alter to a new program until you have carefully evaluated it and figured out how you would benefit from it. Original Medicare will constantly be offered. If you wish to continue getting your advantages in this manner, then you do not have to do anything. This is a managed care plan with a network of service providers who contract with an insurance provider. You agree to follow the guidelines of the HMO and utilize the HMO's companies.This is similar to the Medicare Benefit HMO, except you can utilize providers outside of the network. The providers administer the strategy and take the financial threat. The plan, not Medicare, sets the charge schedule for providers, however providers can bill up to 15%more.

5 Easy Facts About Paul B Insurance Part D Described

You see any companies you select, as long as the company consents to accept the payment schedule. Medical necessity is determined by the plan. paul b insurance part d. This is among the handled care plan types(HMO, HMO w/pos, PPO, PSO) which is formed by a spiritual or fraternal company. paul b insurance part d.

)pays the plan a strategy amount for each month that a beneficiary is enrolled. You have Medicare Part A and Part B.You pay the Medicare Part B premium.

The 6-Minute Rule for Paul B Insurance Part D

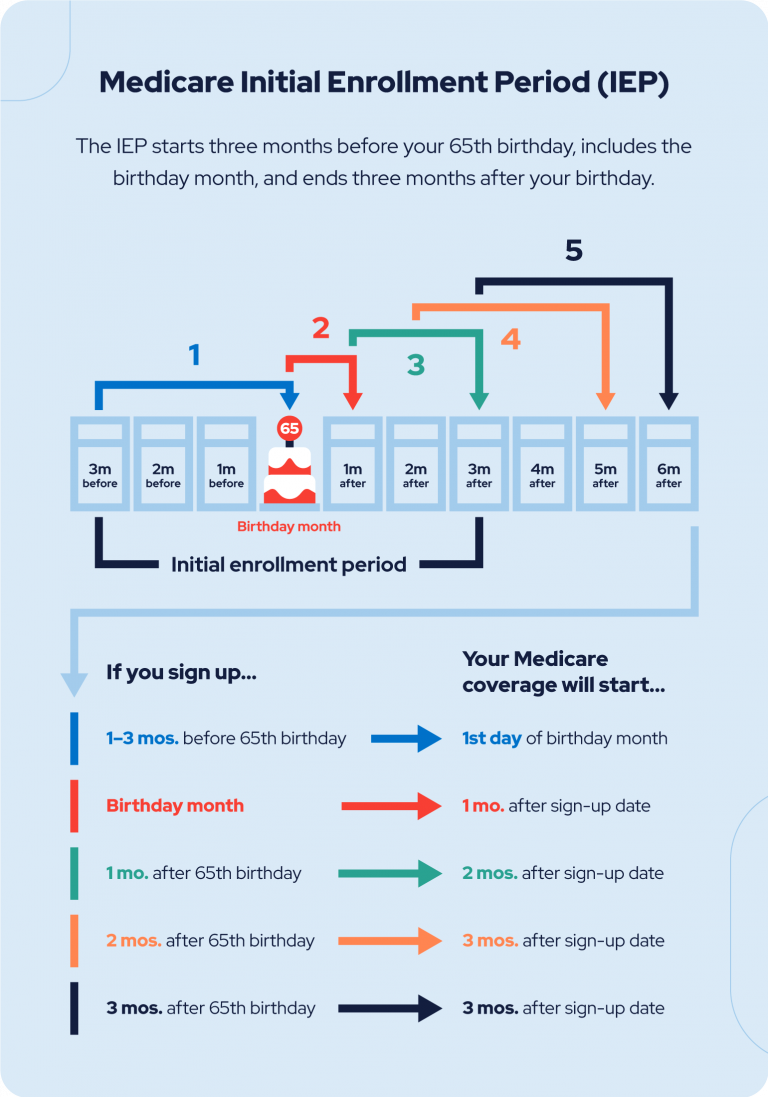

You have Medicare Part A and Part B, or just Part B.You pay the Medicare Part B premium. You live in a county serviced by the plan. Medicare Benefit plans should supply all Medicare covered services and are approved by Medicare. Medicare Benefit plans may supply some services that Medicare doesn't normally cover, such as routine physicals and foot care, dental care, eye tests, prescriptions, hearing aids, and other preventive services. Medicare HMOs may offer some services that Medicare does not usually cover, such as routine physicals and foot care, oral care, eye tests, prescriptions, hearing help, and other preventive services. You do not need a Medicare supplement policy. You have no bills or claim types to finish. Filing and arranging of claims is done by the Medicare Benefit strategy. You have 24-hour access to services, including emergency or immediate care with service providers beyond the network. This includes foreign travel not covered by Medicare. The Medicare Advantage plans should allow you to appeal rejection of claims or services. If the service is still denied, then you have other appeal rights with Medicare. You must live within the service area of the Medicare Resources Benefit strategy. If you move beyond the service area, then you must join a different strategy or get a Medicare supplement policy to choose your Initial Medicare.(Exception: PPOs allow you to use service providers outside of the network, and Medicare will still pay 80% of the authorized quantity. PFFSs do not have a network of companies, however your provider may not accept the plan.)Your present physician or hospital might not become part of the Medicare Benefit network so you would need to choose a brand-new medical professional or healthcare facility. A provider could leave the plan, or the strategy's agreement with Medicare might be canceled (paul b insurance part d). You would have to discover another Medicare Advantage plan or get a Medicare Supplement Policy to go with your Original Medicare. If your Primary Care Physician (PCP)leaves the plan, then you would need to pick another PCP.If you live beyond the strategy area for 12 or more months in a row, the Medicare Advantage plan might ask you to disenroll and re-enroll when you go back to the area. These protections will enable recipients, in particular scenarios, to attempt a plan, but then go back to Original Medicare and a Medicare Supplement policy if they want to do so. Under these protections, beneficiaries will have guarantee problem of a Medicare Supplement policy as long as they satisfy among the following criteria. However, to get these securities, beneficiaries must look for a supplement policy within 63 days of disenrolling from the health insurance, or within 63 days of the termination of the health insurance.

A recipient would be eligible for the Medicare Supplement defenses if they satisfy among the following requirements. The strategy service area no longer covers the county where you live. You vacate the strategy service location. There are infractions by the plan. Defense: In this case, you would get a guaranteed concern of a Medicare Supplement Plan A, B, C, or F from any company (as long as you use within 63 days of losing your other coverage). You disenroll from the plan within 12 months and return to Original Medicare. Protection: You have the ability to return to the exact same Medicare Supplement plan with the exact same business if it is still available. If it is not still offered, you will get a Medicare Supplement strategy A, B, C, or F from any company (as long as you use within 63 days from disenrolling). You pick a primary care supplier within.

Getting My Paul B Insurance Part D To Work

the HMO network. When you stay within the network, you pay nothing except the plan premium and any little copayment quantities preset by the HMO.You may likewise choose to use services outside of the network. When you pick to use a service or service provider outside the Cost Contract HMO network, Medicare would still pay their typical share of

the approved amount. The Cost Contract HMO would not pay these. Expense Contract HMOs may register you if you don't have Medicare Part A but have and pay for Medicare Part B. Cost Agreement HMOs do not need to enlist you if you have end-stage kidney illness or are currently registered in the Medicare hospice program. If you register in a visit this site right here private fee-for-service, you can get care from any Medicare medical professional that consents to the strategy's terms, however you should reside in the plan's service area to be eligible. Medicare pays the plan a set amount every month for each recipient registered in the strategy. The plan pays companies on have a peek at these guys a fee-for-service basis.